Understanding PrimeXBT Funding A Comprehensive Guide

U n d e r s t a n d i n g P r i m e X B T F u n d i n g A C o m p r e h e n s i v e G u i d e

Unlocking the Potential: An In-Depth Look at PrimeXBT Funding

In the ever-evolving world of cryptocurrency trading, understanding financial mechanisms is crucial for traders aiming to optimize their strategies. One such mechanism is PrimeXBT Funding PrimeXBT funding, which plays a pivotal role in margin trading and can significantly influence trading outcomes. This article will delve into the concept of funding on PrimeXBT, explaining its significance, calculations, and how traders can effectively utilize it to enhance their trading experience.

What is PrimeXBT Funding?

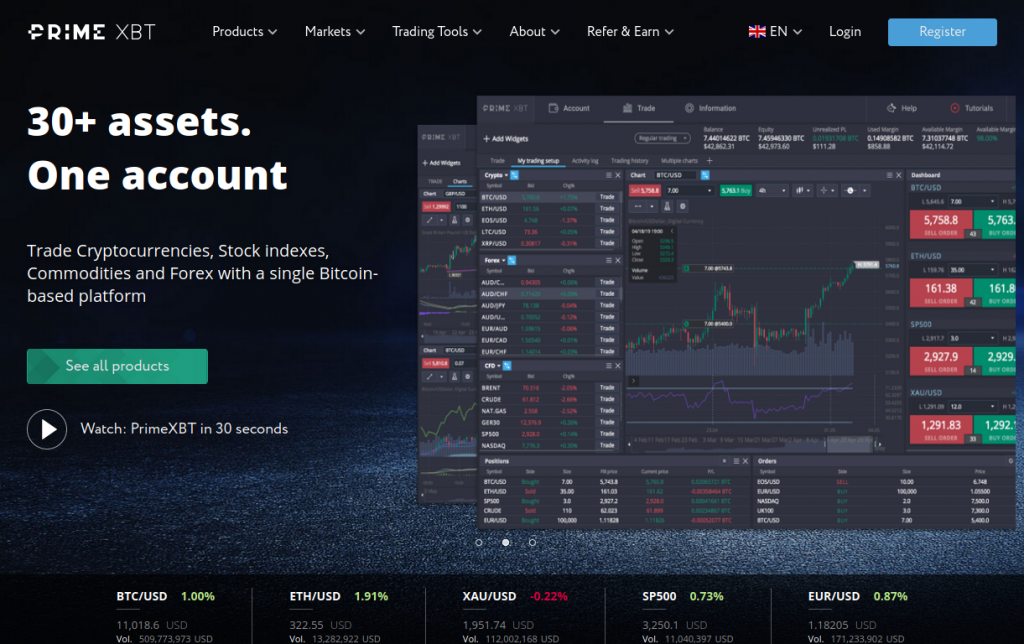

PrimeXBT is a renowned trading platform that offers a plethora of trading options, including forex, commodities, and cryptocurrencies. The term “funding” in this context refers to the interest charges or credits associated with trading positions that are held overnight. Essentially, when a trader opens a leveraged position, they are borrowing funds, and the PrimeXBT platform applies a funding rate, which can either incur charges or provide credits based on market conditions.

The Importance of Funding in Margin Trading

Margin trading allows traders to amplify their positions by borrowing funds to trade larger amounts than their initial capital. However, this comes with accompanying costs — primarily in the form of funding rates. Understanding how funding works is essential for traders, as it directly affects their profitability. Here are several key points regarding the importance of funding in margin trading:

- Cost Management: Traders need to be aware of the funding rates to manage their costs effectively. High funding rates can eat into profits and may influence the decision of whether to hold a position overnight.

- Leverage Risks: While leverage can magnify gains, it can also catalyze losses. Traders should factor in funding costs when calculating potential risks associated with their leveraged positions.

- Strategic Position Closing: Knowing when funding rates are most favorable may influence the timing of closing a position. Traders often aim to close their positions before unfavorable funding rates kick in.

How to Calculate PrimeXBT Funding Rates

Calculating funding rates on PrimeXBT is relatively straightforward, though it can vary depending on market volatility and liquidity. The basic formula involves the following key components:

- Position Size: This is the total amount of your trading position.

- Funding Rate: This is the percentage charged or earned for holding the position overnight.

- Duration: The number of hours or days the position is held overnight will determine the total funding cost.

To calculate the funding fee, you can use the following formula:

Funding Fee = (Position Size x Funding Rate x Duration) / 24

Understanding the intricacies of this calculation is crucial for traders to effectively manage their portfolios.

Strategies to Optimize PrimeXBT Funding Costs

Traders can adopt several strategies to minimize funding costs while maximizing potential profits. Here are some practical tips:

- Trade During Market Hours: Many traders avoid holding positions overnight when funding rates typically apply. By trading during regular market hours, you can reduce your exposure to funding fees.

- Monitor Funding Rates: PrimeXBT provides updates on funding rates. Keeping track of these rates allows traders to make informed decisions on when to enter or exit positions.

- Utilize Short-Term Strategies: Strategies that focus on short-term trades can reduce the number of times you incur funding charges, improving your overall profitability margin.

- Analyze Market Conditions: Understanding the dynamics of supply and demand in the crypto market helps predict funding rate movements, enabling traders to make strategic decisions.

Real-World Examples of Funding Impact

To illustrate the real-world impact of funding rates, consider two hypothetical traders, Alice and Bob:

Alice trades cryptocurrencies with a position size of $10,000, and the funding rate is 0.02% per day. If she holds her position for three days, her funding fee would be calculated as:

Funding Fee = (10,000 x 0.0002 x 3) / 24 = $0.025

Bob, on the other hand, has a larger position size of $50,000, with the same funding rate. If he holds his position for three days, his funding fee would be:

Funding Fee = (50,000 x 0.0002 x 3) / 24 = $0.625

This example underscores how differing position sizes can dramatically affect funding costs, emphasizing the need for traders to consider their individual strategies and capital allocations carefully.

The Future of PrimeXBT Funding and Market Trends

As cryptocurrency markets continue to evolve, so too will the mechanics surrounding PrimeXBT funding and trading strategies. With increasing adoption of cryptocurrencies and advancements in trading technology, funding rates may experience fluctuations influenced by various factors, including:

- Market Sentiment: Bullish or bearish market conditions can impact trading volumes, ultimately influencing funding rates.

- Regulatory Changes: Evolving regulations may alter the dynamics of trading, potentially affecting funding mechanisms on platforms like PrimeXBT.

- Liquidity Factors: Improved liquidity in crypto markets can help stabilize funding rates, while decreased liquidity may lead to more volatility in costs.

Traders must stay informed about market conditions and remain adaptable to fluctuations in funding strategies.

Conclusion

In conclusion, understanding PrimeXBT funding is critical for traders looking to optimize their trading strategies and maximize profitability. By grasping the concepts of funding rates, managing costs, and refining trading approaches, traders can navigate the complexities of margin trading with greater confidence. As the cryptocurrency landscape continues to develop, those who remain educated and adaptable to changes in funding mechanisms will undoubtedly hold a competitive advantage in the trading arena.

Katerina Monroe

@katerinam • More Posts by Katerina

Congratulations on the award, it's well deserved! You guys definitely know what you're doing. Looking forward to my next visit to the winery!